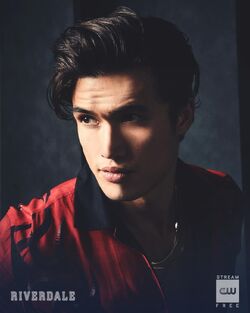

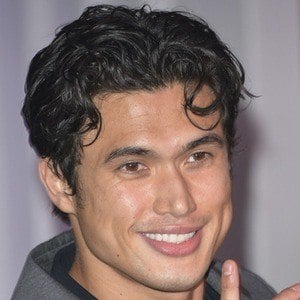

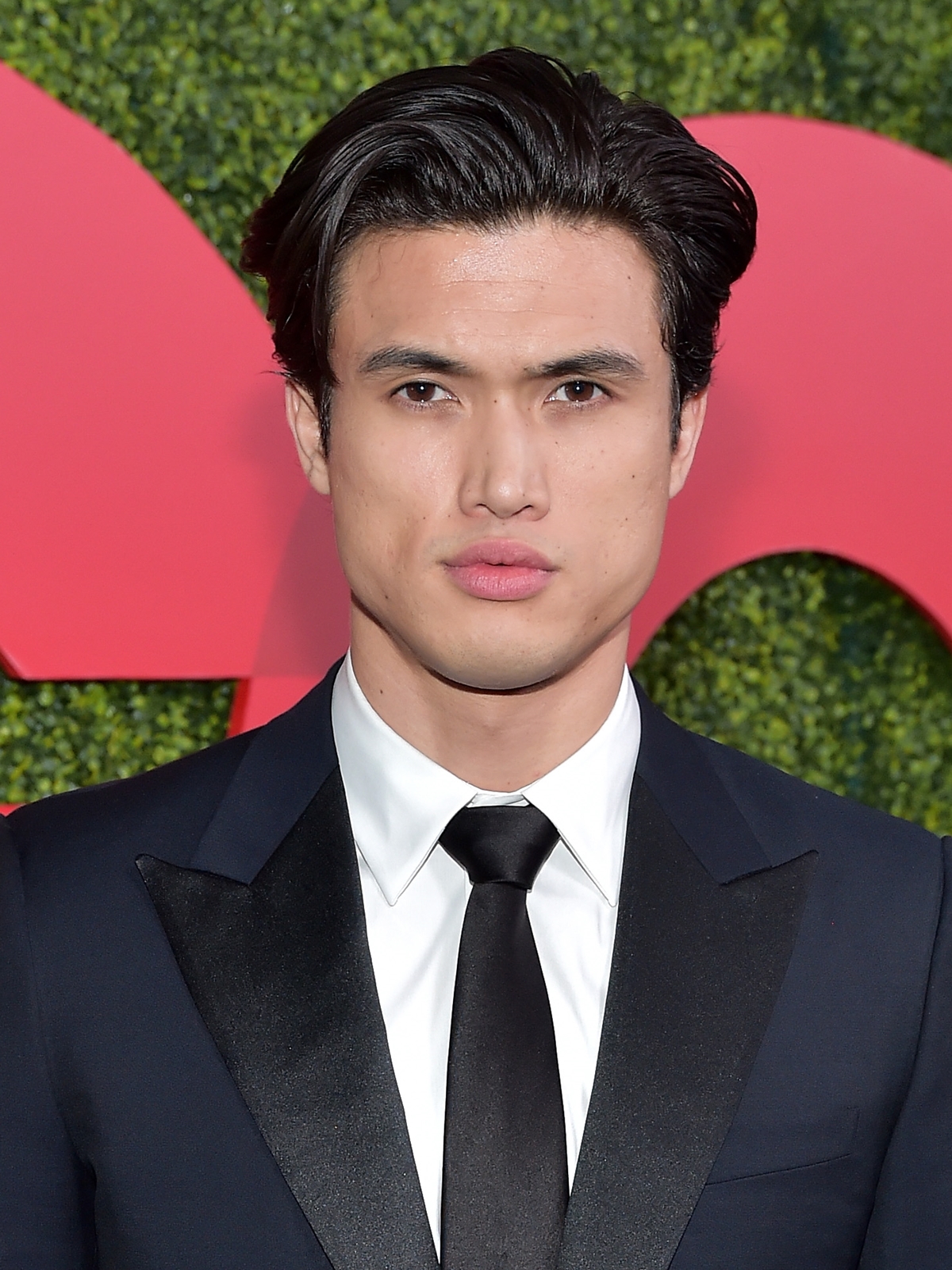

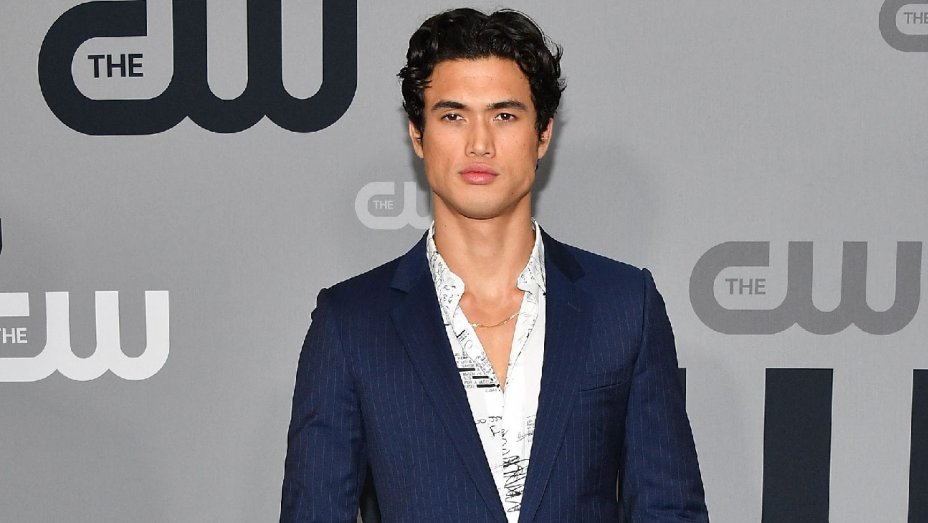

Charles Melton Wiki, Bio, Net worth, Movies & TV shows, Height, Parents - Thecelebscloset Charles Melton Wiki, Bio, Net worth, Movies & Tv shows, Height, Parents

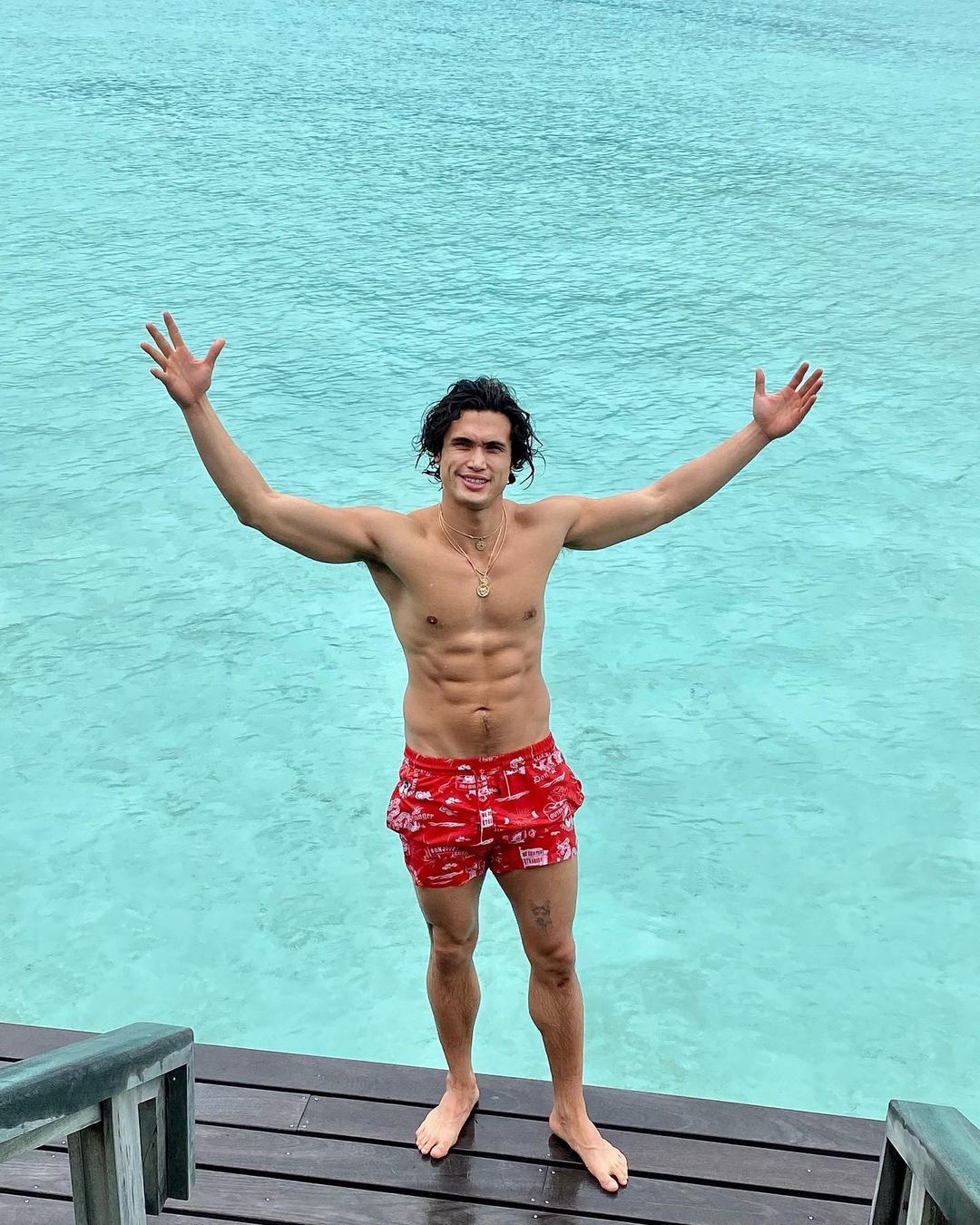

Riverdale" Actor Charles Melton Reconciles With His Korean Heritage And Speaks Out About Anti-Asian Hate Crimes - Koreaboo

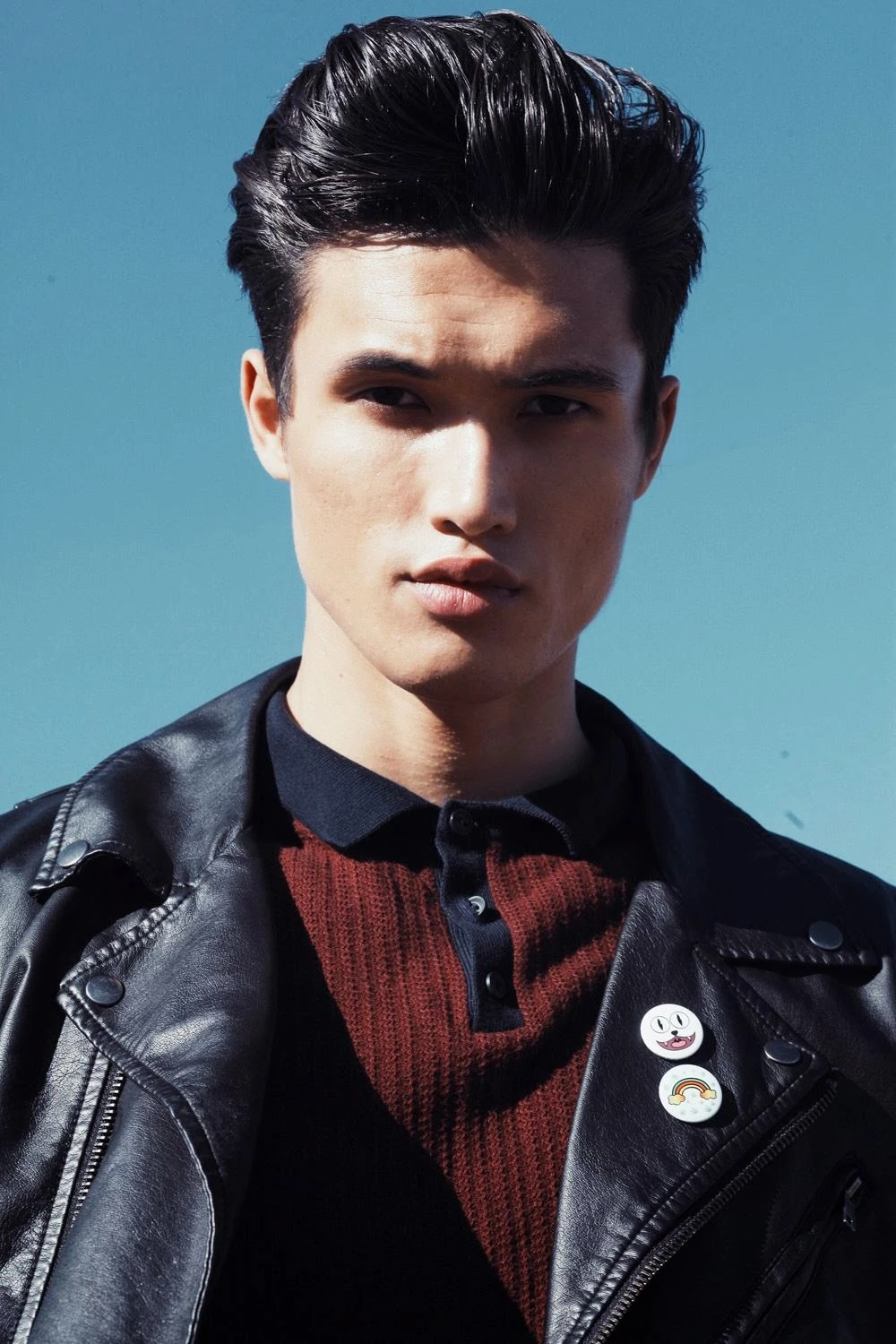

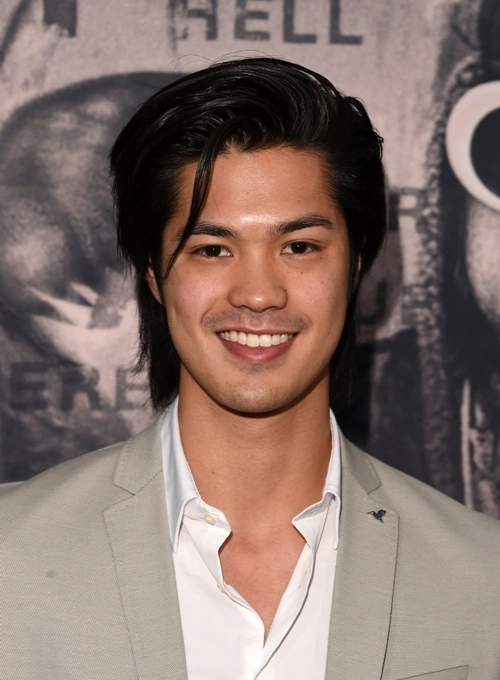

![Charles Melton Modeling | Bull Rush: Charles Melton @ Vision/DNA [Preview] – Richard Pier ... | Videos divertidos, Imagenes chidas, Chicas Charles Melton Modeling | Bull Rush: Charles Melton @ Vision/DNA [Preview] – Richard Pier ... | Videos divertidos, Imagenes chidas, Chicas](https://i.pinimg.com/736x/cd/f1/c6/cdf1c6179faffb7151c881c0f65cafea.jpg)

Charles Melton Modeling | Bull Rush: Charles Melton @ Vision/DNA [Preview] – Richard Pier ... | Videos divertidos, Imagenes chidas, Chicas

Charles Melton (Actor) Wiki, Bio, Age, Height, Weight, Girlfriend, Net Worth, Family, Career, Facts - Starsgab